In the coming weeks, traditional economic measures will begin to capture the impact of social distancing and the wholesale economic shutdown.

While many of these measures are lagging indicators, and may already be priced into markets, investor sentiment could still take a hit. There is still much data to come, but what we do know is:

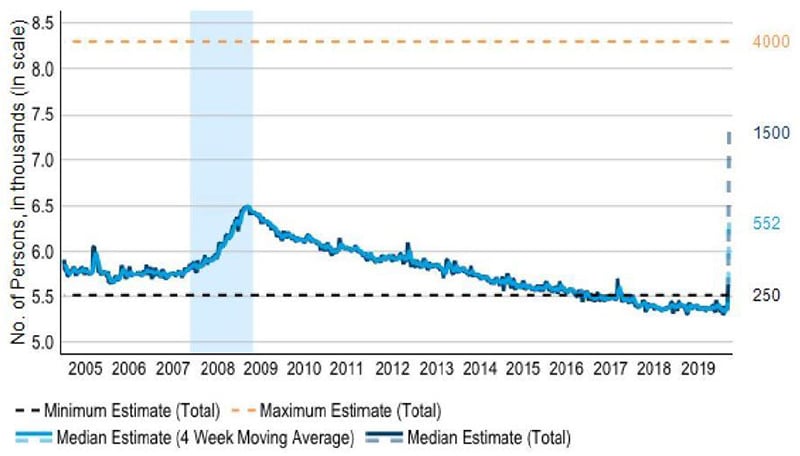

- Data on people filing for unemployment benefits for the week ending 14 March 2020 showed that the coronavirus is starting to have an impact on the US economy. Initial jobless claims rose to a two and a half year high of 281,000 last week – up from 211,000 earlier in the month1

- Timely state-level data suggests an unprecedented surge in claims over the next few weeks as layoffs increase

- Aggressive virus containment measures implemented in the past few days are resulting in a near shutdown of activity in sectors such as travel, leisure and many parts of retail, with a devastating impact on the labour market and ultimately on the US economy

- National statistics to be released on 26 March 2020 will likely show a large increase in claims from these already elevated current levels. Bloomberg consensus estimates suggest claims averaging 1.5 million with a wide range of predictions from 500,000 to four million.

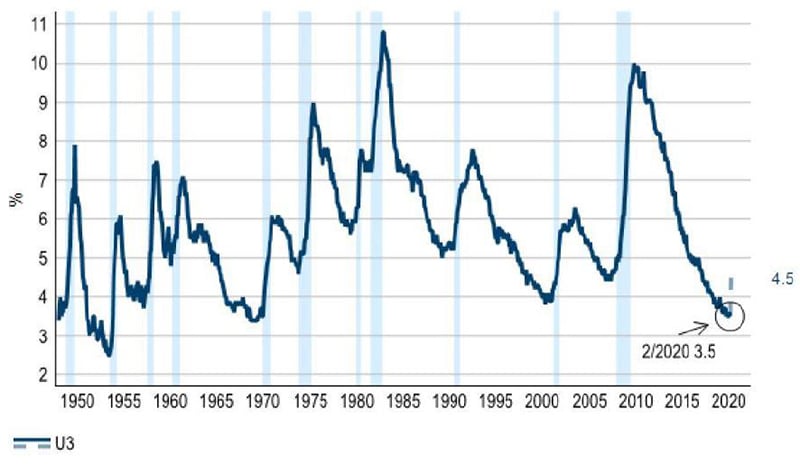

- An increase of 1.5 million in unemployment claims is instantly going to push the unemployment rate to 4.5% from the current 3.5%, but that data is released in the monthly payroll report from the Department of Labor with a considerable lag. (Note: the period of survey for the March payroll report, to be released on 3 April, ends on 12 March and will not accurately depict the current level of stress in the labour market. March disruption will show up in the April payroll to be released on the first Friday of May.)

Labour market data is the most reliable indicator that a US recession is underway. The figure for national unemployment claims – to be released on 26 March 2020 – will likely confirm it. As the virus-induced shutdown ends and activity begins to normalise, we expect claims and the unemployment rate to edge down. After a rude shock, US activity will also slowly return to normal levels.

Figure 1: Initial claims for unemployment insurance (US)

Source: Macrobond/Department of Labor/Columbia Threadneedle Investments, 25/3/2020

Despite its timeliness, weekly jobless claims and other economic data are in reality lagging indicators of a contraction in economic activity. Financial markets have already reacted to the possibility of a sudden and sharp slowdown in activity and the subsequent hit to earnings.

The duration and the intensity of the recession depends on the duration of the shutdown and whether there is an adequate policy response from monetary and fiscal authorities to help cushion the blow. Early signs are encouraging. These past two weeks have seen a swift and substantial response from the Federal Reserve and a fiscal policy response is underway to help support the economy. Nevertheless, economic data in the coming months is likely to paint a bleak picture of the US economy.

Source: Macrobond/Bureau of Labor Statistics/Columbia Threadneedle Investments, 25/3/2020.