Plastics are a growing environmental problem and increasingly a focal point for policy at national and international level. In recent months, the UN has agreed to develop a global treaty on plastics which could include cuts in virgin plastic production, as well as increasing collection and recycling infrastructure. At a national level, in April the UK implemented a plastics tax which will apply charges of £200 a tonne to plastic packaging that contains less than 30% recycled plastic.

Plastic producers

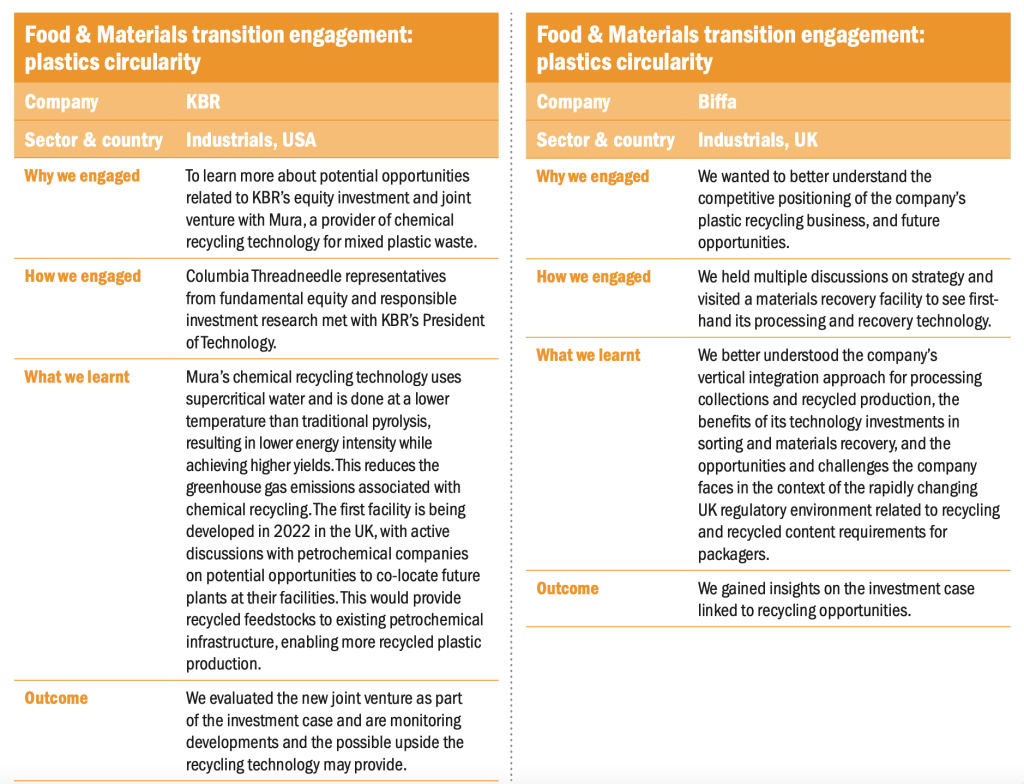

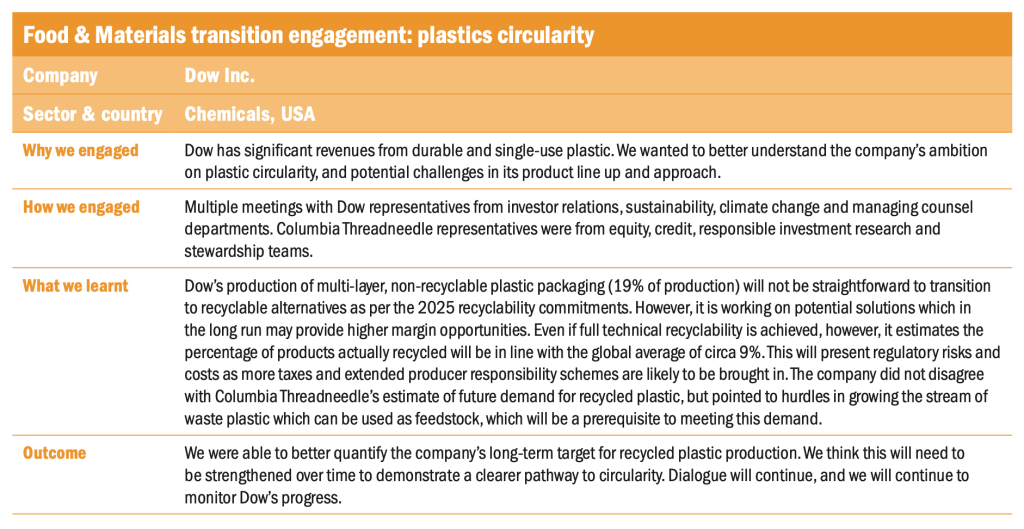

In this context, a shift of this scale will require big changes for plastic producers. Companies that will be most resilient to these changes are likely to be those that have well developed circular strategies, as well as other advantages including: lower revenue dependence on non-recyclable plastic; a strategy and related targets for recycled production that is meaningful relative to the company’s production volumes; evidence of multiple partnerships and efforts to pilot and scale new technologies, such as chemical recycling, that can enable the company to adapt and nimbly respond to technical or other challenges; the ability to maintain and grow customer relationships through the transition, by working with customers to develop new and possibly higher-value products and forms of packaging; and access to low- cost virgin plastic feedstocks that will remain economically competitive in a scenario of slowing demand growth for virgin plastic.

Our analysis of several plastic producers against these criteria shows a mixed picture, with companies’ plans for increasing recycled production accounting for anywhere between 1% and 22% of their estimated 2030 production. The range and depth of company partnerships in relation to new technologies such as chemical recycling also varies significantly.

Waste and recycling

This shift to recycled plastic will also present big changes for the waste and recycling sector. The landscape of risks and opportunities across countries is variable given the different degree of recycling infrastructure, public education and collection rates. However, with rapidly growing regulatory changes and demand for recycled plastic, waste companies that are well positioned can reap the benefit of investment in new technologies, including advanced sorting technologies that can increase automation in facilities and recovery rates for materials, capturing the most value from waste plastic. Some waste companies may also benefit where they have opportunities to vertically integrate, increasing the degree of recycling and processing carried out on plastic collections.

To match increased demand, however, the scale of investments required will be vast: including improved collection and processing infrastructure, not just in developed markets with low recovery rates (for example the US), but in emerging markets with less developed infrastructure. As with plastic producers, a review of companies’ capital expenditure plans and future targets for increasing material recovery provides an indication of their plans and positioning for this transition.

Conclusion

Our analysis concluded with the recognition that there is a need for ongoing monitoring given the rapid developments on this theme. Continued research, collaboration and engagement across the fundamental and responsible investment thematic teams will help us to identify possible winners and losers and to encourage companies to continue to develop their circularity strategies.